Insurance Portfolio Optimisation

Why is it essential to review the small print?

Our review highlights any key exclusions or sub limits that are in the fine print and have potential to cause claim disputes or delays in claim payment.

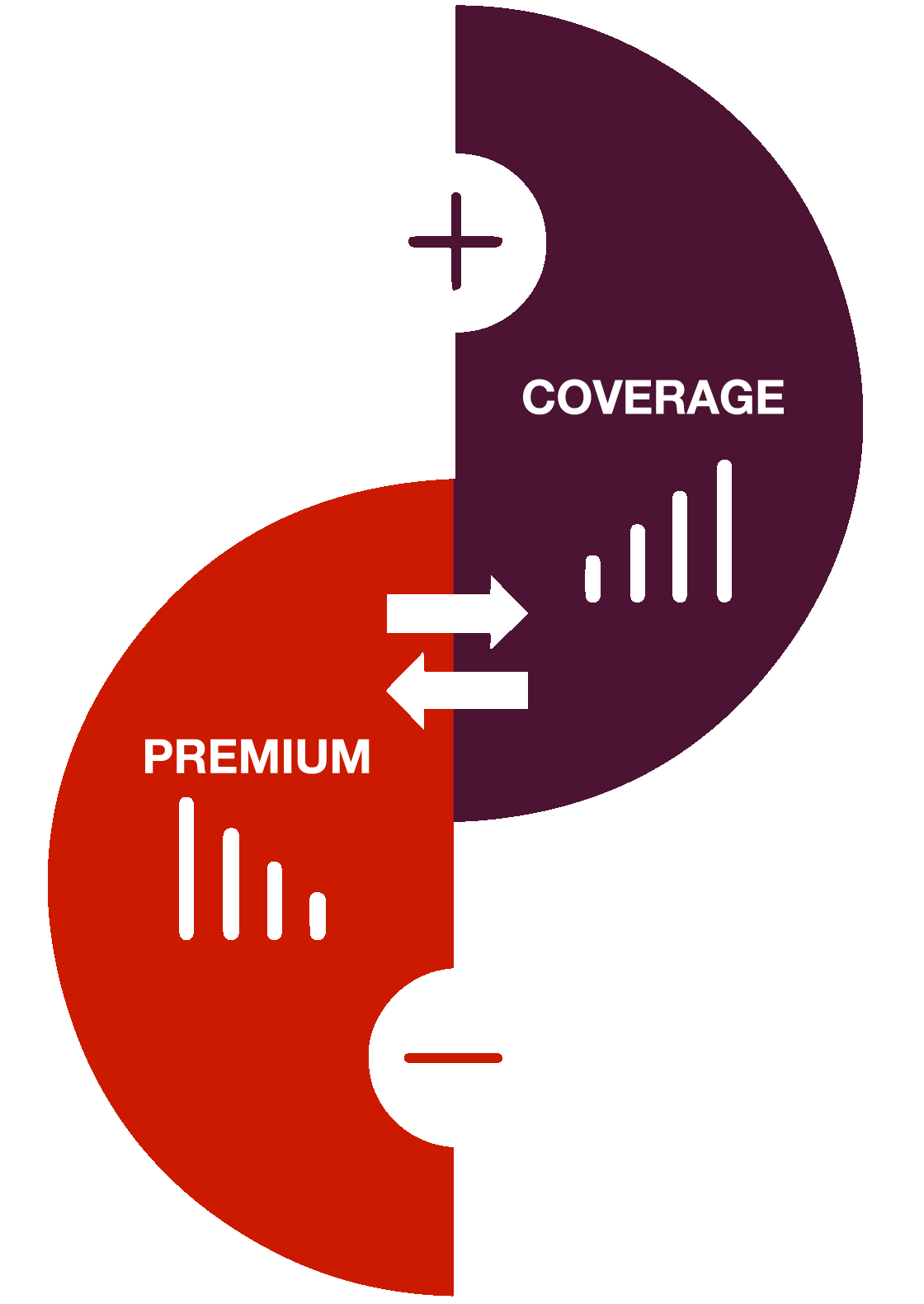

The above exercise enhances team awareness around insurance. Many a time, claim delays occur due to the expectation gap between what the policy actually covers and what clients believe it covers. Moreover, by performing this exercise, our clients are able to negotiate premiums from an informed point of view.

Are you paying the right premium against market benchmarks?

As independent consultants, we benchmark your premiums against industry data. This helps provide assurance to you that your premium rates are in line with the industry as well as your risk exposures. Superior coverage and premium savings can be achieved by portfolio restructuring, floating covers where possible across business divisions, negotiating better terms and conditions and engaging in policy enhancements.